Jewelry is one of the world’s oldest archaeological artifacts, having been used for centuries across cultures to mark social status, store wealth and symbolize personal meaning.

In the 21st century, it’s common to own designer jewelry collections, engagement and wedding rings, and antique heirlooms. But whether a Rolex watch, an engagement ring or grandma’s authentic art deco earrings, it’s important to have insurance to protect your jewelry’s value.

Why insure jewelry?

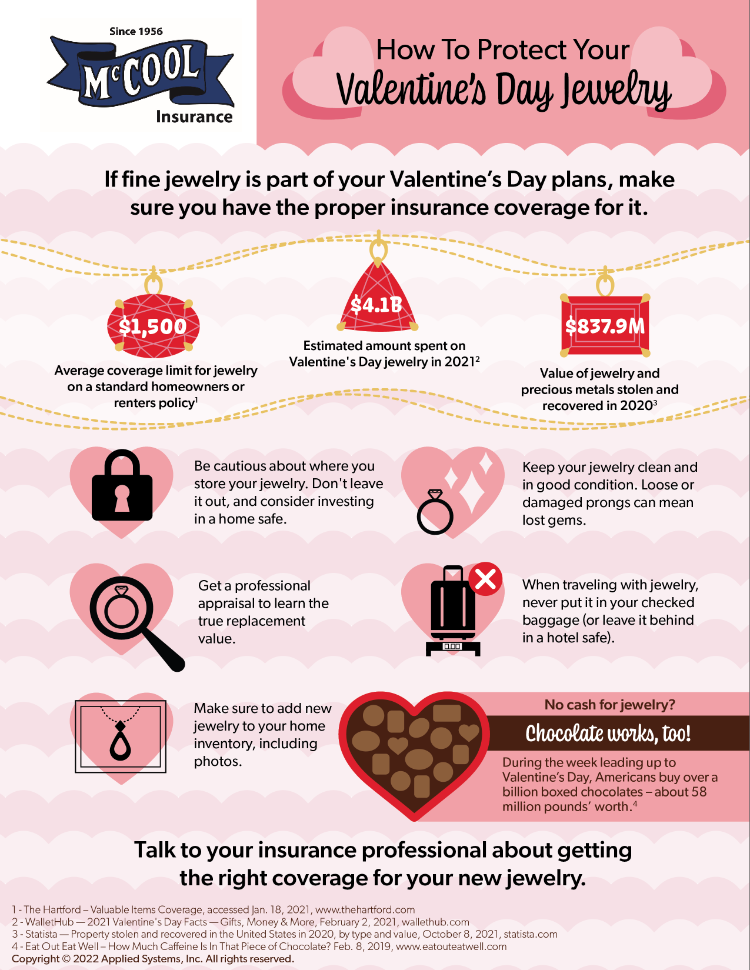

Jewelry is covered under most homeowners and renters insurance policies, but many have exclusions and coverage limits. A basic policy may have limits as low as $1,500. While theft is typically a covered peril, damage or accidental loss may not be.

A jewelry rider (floater) or specialty jewelry insurance policy can offer added protection. Coverage is more comprehensive and normally insures the replacement value. This may involve an appraisal.

Additionally, jewelry insurance often offers coverage for “disappearances,” or losses where the timeline cannot be reconstructed, as well as worldwide travel coverage for loss or damage. That means if you lose your diamond earring while swimming in the ocean in Bora Bora, a specialty jewelry policy will keep you from ugly-crying over the loss.

How to protect jewelry

Even with a jewelry policy in place, it’s important to keep your items safe.

- Store them securely. Keeping jewelry in a home safe may feel more secure than shoving it in the bottom of the sock drawer, but many retail safes can be just as insecure. Thieves can easily lift a lightweight safe and chuck it down the stairs or out the window and make a run with it. Instead, use a heavy, well-made safe bolted into the wall or floor in a hidden area on a lower level of the home. The investment in a high-quality safe can be worth its weight in all your gold for the protection it offers.

- Take precautions when traveling. Speaking of safes, when traveling, assess the hotel room safe before putting items in it. While the safest place for jewelry when you’re traveling is to keep it at home, if the room safe doesn’t seem up to snuff, try asking hotel staff to keep items in the hotel’s master safe.

- Regular upkeep is key. Of course, jewelry isn’t much fun when it’s always locked away and out of sight. It is meant to be worn after all, but before you sport it out and about, inspect pieces to ensure clasps work and prongs are keeping stones in place. Make sure jewelry can’t break easily or fall off before heading out the door. This is especially important for older, antique pieces or heirlooms that have passed through many hands.

- Don’t flaunt it. Not everyone can tell if your Tiffany & Co. piece is designer or not — and that’s a good thing. When traveling with jewelry, avoid transporting items in branded containers (like that iconic blue box). When having a piece repaired or altered, try bringing it to the jeweler it was purchased from to limit how many people know about the piece.

- Keep appraisals up to date. The only thing worse than a jewelry loss might be not receiving proper compensation for it. Specialty insurers typically cover jewelry for up to 150% of the value. Have jewelry appraised to ensure it’s covered for the right amount.

- Stay on top of jewelry inflation. To account for jewelry inflation, appraisals should be updated at least every three to five years. Appraisals should be conducted and verified by a professional. Documentation verifying authenticity, photos and any related receipts should also be saved to ensure proper valuation.

- Jewelry insurance isn’t one and done. It’s important to reevaluate your jewelry insurance policy. Every year, take an inventory of all your jewelry. Then contact your agent for a policy review.

Jewelry should be worn and stored in the safest ways possible. Talk to your insurance agent about your best options for loss protection. Full replacement of your jewelry set in the event of a loss will keep you looking like a million!

This content is for informational purposes only and not for the purpose of providing professional, financial, medical or legal advice. You should contact your licensed professional to obtain advice with respect to any particular issue or problem.

Copyright © 2021 Applied Systems, Inc. All rights reserved.